AN EDUCATED WORKFORCE FOR THE “INFORMATION AGE” UNITED STATES

“The U.S. economy’s largest and fastest growing sectors—business services, finance, healthcare and education—have little room for high school educated workers,” notes a 2015 report from Georgetown University’s Center on Education and the Workforce.

“Access to education is pretty much the arbiter of middle-class status,” said Anthony P. Carnevale. “It becomes the nut you have to crack.”

How to help young Americans to secure a better future?

There is no end to the list of items we could spend on “those in need.”

We could help Americans by making more taxpayer money available for health care, after school programs, neo-natal programs, housing assistance, drug rehab programs, free child care, winter heating assistance, food stamps, grants for college — and heed calls for a Universal Basic Income. The list of needs for the needy is almost endless. So is the seeming need. So many have their hand out for help.

I wish we could satisfy them all. But resources are finite, and we have to choose where are our priorities. Where can we get the best return for public money spent to help fight poverty? To increase social and economic mobility?

I would like to make a plug for increasing spending on higher education as a means towards that worthy end.

I don’t really advocate a huge increase in K-12 spending, even though that is where I work. Even with more money the system will not improve much because of the politics involved, in my opinion. Public education at the elementary and secondary levels will putter around doing well or not depending on the place and the people involved. Investing much more money in such a lackluster operation as is the K-12 system will be to get a very uncertain return on the investment. How much would academic achievement increase if we doubled or tripled the amount we spend on K-12? Not very much, I am afraid.

And, for similar reasons, I would not greatly increase money on food stamps or welfare payments. There would be some amelioration in the pains of making this payment or that grocery bill, and that would be wonderful. But poor families are generally poor for a reason, and their ability to increase value is low.

As I have seen it, most American families slug along as best as they can. Their kids are average students en route to maximizing their average ability to make money and have a career. But the results will be less than astounding. They will hang in there, more or less. Average. These kids don’t particularly like school but don’t particularly dislike it, either. They are… meh. Probably not going to graduate from a four year college. In high school they were “C” students, God help em.

But all socio-economic levels, including the poor, have their standout children. Those who are imbued with the spark that leads to achievement in school. Those who are genuinely interested in math or literature. Those who read Neil deGrasse Tyson’s science articles online in their spare time or watch “Drunk History” videos on Youtube. They are intellectually curious, do well in school, and are set to succeed in college. I have met many many such students.

The ones whose parents have money will have no problems making their way through college and into middle class (or better) jobs.

The ones whose families don’t have money will struggle. And they will struggle much harder than similar students did thirty years ago. This is what I really want to talk about in this essay.

Take such a high school student in 1985, the year I graduated from high school and started college at UC Irvine. Tuition was $450 three times per year, plus another $100 or so for books each quarter. Then you would have to pay for room and board. It cost money but was doable. In fact, I paid most of my last year of college at UCLA just to show I could. I worked full time and paid most of my tuition, room and board. I guess I was trying to prove that I was “a man” to my father, or something. (In retrospect, I wish I would have worked less and studied more.)

A friend told me recently she had paid $33,000 for her daughter’s first year at UCLA. Even adjusting for inflation, the cost of college has risen enormously. And it would seem to be even worse at private schools. The full cost of one year of college at the University of Southern California is currently 72,000. That is dollars, not pesos.

How did this happen?

Some of it is due, they tell me, to colleges and their inability to control costs. Much of it comes from state legislatures refusing to fund public higher education at previous levels, as the amount of money colleges receive from taxpayers has been declining for decades. Since students benefit so much financially from a college degree nowadays, it is said, they should shoulder more of the burden of paying for their college degrees. The legislature has backed away from full funding.

The result is, in my experience, high school seniors having increasingly stressful conversations about possibly taking tens of thousands of dollars in loans to pay for college. They have to decide soon. It is parents taking out equity from their homes or borrowing against their retirement savings, in order to help their kids get that important college degree. They are almost ready to bankrupt themselves to help their children get a solid education. It is kids taking out student loans which will burden at least a good part of their young adulthoods to pay back.

How did we allow it to get this way?

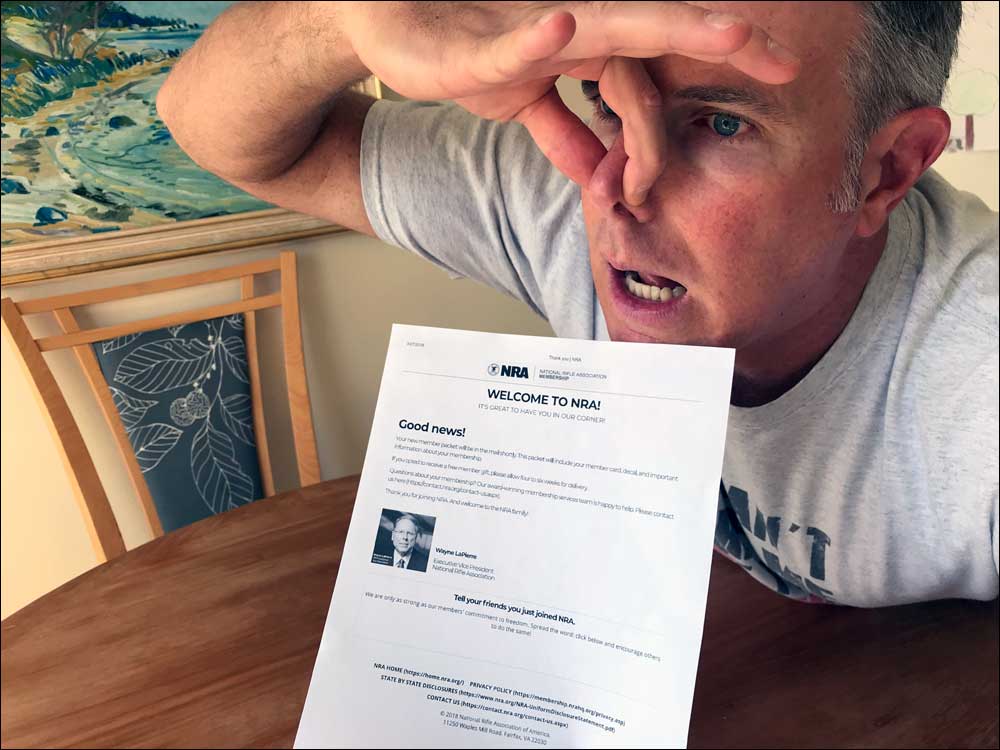

As a taxpayer I am peeved. As a teacher I am angry. As a parent I am enraged.

18 year olds are warned not to get pregnant, to marry, to do drugs, or to drink alcohol. There is a push to disallow 18 year olds to buy firearms. But we almost encourage them to make the huge financial decision to borrow forty grand a year for college? To graduate at 21 with a theater arts degree with $140,000 in non-dischargeable student debt?

This is the way it used to be: a kid whose parents were from Mexico could graduate from Channel Island High School in Oxnard (a mediocre academic institution) with a “B” average in 1975. This was a generally good kid who tried in school and whose teachers liked him. He would then attend Cal State Long Beach for a very reasonable cost. He could attend classes there, write the essays and read the books, fall in and out of love, mature and grow up, and come closer to identifying where he might fit into the adult world. This kid could graduate from college and then have a ladder to an American middle class job — something his parents from Mexico could not achieve. This is social mobility; this is what America should be all about. That young adult from Oxnard will more than re-pay society’s investment in his university education with increased taxes taken from his better paying job prospects. This is a good investment. It is investing in the future mass middle class, as was the GI Bill after WWII. This was California in 1955, 1965, 1975, and 1985.

It began to change in the 1990s with steeply rising college tuition, and that same student from Channel Islands High School today in 2018 finds himself in a much more precarious position in paying for college. The situation is changed; the decisions are more difficult. Should he take out serious loans to go to a four year school and worry about his ability to pay them off? Work for so many hours in a part-time job that it becomes difficult to attend class and complete his classwork? Or go to a community college for two years while working, and then transfer to a four year school and take loans out for that? I have these conversations with high school seniors all the time. The talk is intense and complicated; there is so much at stake. Students can feel overwhelmed by the money involved. They are having to grow up much sooner than students in the past. It is sad to see.

My father attended UC Berkeley’s “Boalt Hall” Law School in 1961 for $50 a semester. An education was almost free in those days – even in a professional program as potentially lucrative as law. Not anymore. Boalt Hall tuition in 2018 is currently $49,364. That is a HUGE change.

I am not the first person to notice that the increasing cost of a university education has meant that college has stopped being an engine of socioeconomic gain in the United States and instead come to reinforce economic privilege. In 2018 the well off almost always send their children to college where they graduate. The poor — even the better high school students from poor families — increasingly do not go to college, or they fail to graduate. The transfer rates of community college to four year schools are low.

Much of it comes down to money. What if that kid from Oxnard suffers a reverse in his personal life (a death in the family, a heartbreak, or something else) and takes a semester off? What if a student has a bad spell in the classroom with poor grades? These is less wiggle room for college students now, less room for error: every semester is super-expensive, so taking time off here or there can imperil the whole venture. A student has to be very careful.

Some 40% of college students start college but fail to graduate. Some of them probably never should have been in college to begin with — but many drop out for financial reasons, or they have a mental health emergency or existential life crisis, and then they leave for a semester and never return. Some stress so much about money and loans and then they quit.

I had it so much better back in 1985 when I started at UC Irvine and then ended at UCLA. My young adult years were more carefree; I was able to enjoy more being in college. The money question was not looming overhead like the Sword of Damocles, as it does so often now. The same was true with my father in 1961 at UC Berkeley Law School.

Last night after our match I had dinner with a tennis buddy who told me he went to UC Davis Medical School in the early 1980s for $4,500 per year. How much does that cost now? It costs approximately $36,000 per year. Even adjusted for inflation this is a huge increase.

In my opinion, spending money for general (and numerous) anti-poverty programs in California is like pissing into a black hole: you could spend almost an infinite amount of money with little discernible result.

But spending money to return public university tuition to what it was in 1985 would be expensive but worth the cost, in my opinion. It would be an investment in the middle class of the future. It would be a blow against the income inequality that has increased so much in the last three decades. It would allow that kid from Oxnard to escape more easily the poverty of his upbringing and join the California middle class.* It would allow for more social and economic mobility, something so important to the American ethos.

Spending huge amounts on the California prison system? Trying to build housing for hundreds of thousands of homeless people? Trying to guarantee health care for all Californians, even those with no money, at public expense? Trying to pay for universal daycare and pre-K? Trying to improve the K-12 system in its existing form?

I am not sanguine.

But to return public university tuition to what is was in 1985? I am all on board.

Do two things: take a hatchet to how Cal State and UC schools spend their money and drastically shrink the costs, changing what those schools offer (getting rid of non-essential programs); and increase funding significantly from the California State legislature. Both these goals are possible with the necessary political will.

Try to take California back thirty years to when in many ways the state was less like a Third World country of “haves” and “have nots.”

I know the economic situation in California is much more complicated than college costs, but this would be one stroke towards increasing social mobility and re-building the Golden State middle class. 1985 was not so long ago.

And so I have made this modest proposal.

* I do know that academically strong kids from impoverished families can go to certain private universities almost for free. Still, most poor kids (especially those without stellar GPAs) will attend public universities where there is less financial aid help. They will be on their own.